From Saving to Investing: How to Build Wealth on a Modest Budget

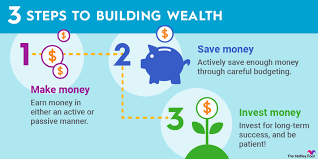

Building wealth often seems like an unattainable goal, especially when living on a modest budget. However, wealth creation is not solely about how much money you make; it’s about how you manage, save, and invest what you have. With strategic financial planning, disciplined saving habits, and smart investments, you can grow your wealth even with limited resources.

This article provides a comprehensive guide on transitioning from saving to investing, offering practical steps to help you build wealth on a modest budget.

1. Understanding the Importance of Wealth Building

Wealth building is not just about accumulating money; it’s about creating financial security, independence, and opportunities for a better future. It enables you to:

- Cover unexpected expenses without stress.

- Achieve long-term goals like buying a home, funding education, or retiring comfortably.

- Leave a financial legacy for your loved ones.

Even on a modest budget, adopting the right mindset and strategies can set you on the path to financial freedom.

2. Start with a Solid Savings Foundation

Before diving into investing, it’s essential to build a strong savings foundation. Here’s how:

Set Up an Emergency Fund

An emergency fund acts as a safety net for unexpected expenses like medical bills or car repairs. Aim to save at least 3-6 months’ worth of living expenses in a separate, easily accessible account.

Track Your Spending

Use budgeting apps or spreadsheets to monitor your income and expenses. Identify areas where you can cut back to free up money for savings and investments.

Automate Your Savings

Set up automatic transfers to your savings account each payday. Automating savings ensures consistency and removes the temptation to spend.

3. Establish Financial Goals

Clear financial goals provide direction and motivation for your wealth-building journey. Ask yourself:

- What do you want to achieve? (e.g., buying a home, retiring early, starting a business)

- How much money will you need?

- By when do you want to achieve these goals?

Break your goals into short-term, medium-term, and long-term categories. For example:

- Short-term: Save $5,000 for a vacation in two years.

- Medium-term: Pay off $10,000 in debt within five years.

- Long-term: Build a $500,000 retirement fund over 30 years.

4. Manage Debt Effectively

Debt can hinder wealth-building efforts, especially if high-interest loans consume a significant portion of your income. To manage debt:

- Prioritize High-Interest Debt: Focus on paying off credit card debt or payday loans first, as these typically have the highest interest rates.

- Consolidate Debt: Consider consolidating multiple debts into a single loan with a lower interest rate.

- Avoid New Debt: Only take on debt for essential purposes, such as buying a home or furthering education.

Paying off debt not only reduces financial stress but also frees up money for saving and investing.

5. Transitioning from Saving to Investing

Once you’ve established a savings cushion and managed your debt, it’s time to start investing. Investing allows your money to grow over time, thanks to the power of compound interest.

Why Invest?

- Savings accounts often have low interest rates, barely keeping up with inflation.

- Investing offers higher potential returns, helping you grow wealth faster.

Start Small

You don’t need thousands of dollars to begin investing. Many platforms allow you to start with as little as $10 or $20. The key is to start early and invest consistently.

6. Investment Options for Modest Budgets

Here are some beginner-friendly investment options:

1. Stock Market

Investing in stocks allows you to own a small part of a company. Over time, stocks can provide significant returns, although they come with risks.

- Exchange-Traded Funds (ETFs): These are collections of stocks or bonds that trade on the stock market. ETFs offer diversification and lower risk compared to individual stocks.

- Fractional Shares: Platforms like Robinhood or Acorns let you buy portions of expensive stocks, making investing more accessible.

2. Retirement Accounts

Contribute to retirement accounts like a 401(k) or IRA (Individual Retirement Account). These accounts offer tax advantages that help your money grow faster.

- If your employer offers a 401(k) with matching contributions, take full advantage of it. This is essentially free money.

3. Real Estate Crowdfunding

If traditional real estate investment is out of reach, consider real estate crowdfunding platforms. These allow you to invest small amounts in property projects and earn passive income.

4. Robo-Advisors

Robo-advisors are automated platforms that manage your investments based on your goals and risk tolerance. They are ideal for beginners who lack the time or knowledge to manage their portfolios.

5. High-Yield Savings Accounts and Certificates of Deposit (CDs)

While not technically investments, these options offer higher returns than regular savings accounts and are low-risk.

7. The Power of Consistency and Compound Interest

One of the most powerful wealth-building tools is compound interest, where your investments earn returns, and those returns generate even more returns.

For example:

- Investing $100 per month at an average annual return of 7% could grow to $120,000 in 30 years.

- The earlier you start, the more time your money has to grow.

Consistency is key. Even small, regular contributions can add up over time.

8. Minimize Expenses and Fees

Investment fees, though seemingly small, can eat into your returns over time. Choose low-cost investment platforms and funds to maximize your earnings.

Additionally, maintain a frugal lifestyle to free up more money for investments. For example:

- Cook meals at home instead of dining out.

- Buy used items instead of new ones.

- Cancel unused subscriptions.

9. Educate Yourself

Financial literacy is essential for successful wealth building. Educate yourself about personal finance, investing, and money management through:

- Books (e.g., The Intelligent Investor by Benjamin Graham).

- Podcasts and YouTube channels focused on finance.

- Online courses and workshops.

The more you know, the better equipped you’ll be to make informed financial decisions.

10. Stay Patient and Avoid Emotional Decisions

Investing is a long-term game. Markets will fluctuate, but it’s essential to stay focused on your goals and avoid making impulsive decisions based on short-term market movements.

Adopt a diversified investment strategy to spread risk across different assets. Diversification reduces the impact of any single investment’s poor performance.

11. Reassess and Adjust Your Strategy

As your income grows or your financial goals change, reassess your savings and investment strategies. Increase your contributions whenever possible and explore new investment opportunities that align with your risk tolerance and goals.

Final Thoughts

Building wealth on a modest budget is not about making drastic changes overnight; it’s about taking consistent, small steps toward financial stability and growth. By focusing on saving, investing wisely, and educating yourself, you can create a secure financial future, no matter your starting point.

Remember, the journey to wealth is a marathon, not a sprint. Start today, stay disciplined, and watch your modest investments grow into significant wealth over time.